Giving Stock Could be More Beneficial than Cash

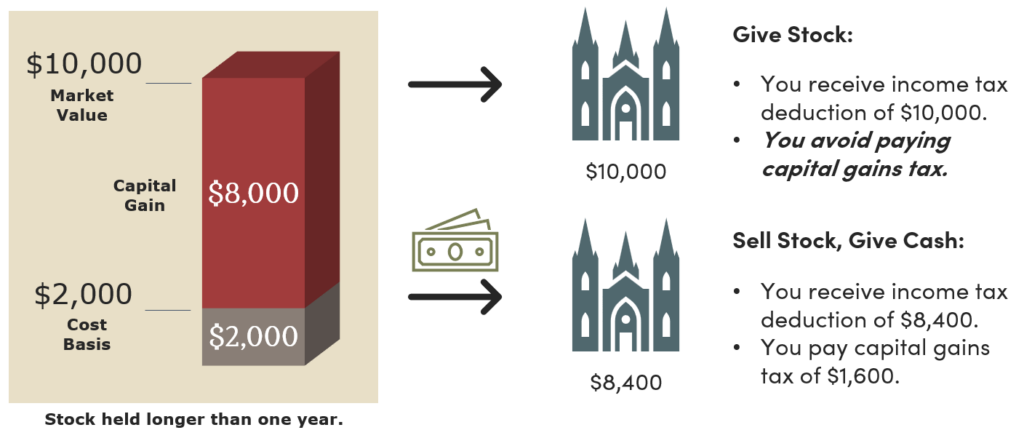

When you make a gift of appreciated stock to the Acton Institute, you could receive:

- a charitable tax deduction for the market value of your gift AND

- eliminate the capital gains tax that would be due upon selling the stock if you haveowned it for longer than one year.

To transfer shares of public stock to the Acton Institute, please provide the following information to your financial institution to initiate the transfer:

Stifel (Head Office)

501 N. Broadway

St. Louis, MO 63102

Stifel – PearlStreet (Local Office)

250 Pearl Street

Grand Rapids, MI 49503

DTC # 0793

Account Number: 74596423

(Account Registration: Acton Institute)

Local Contact: June Matthysse or Emily Rowe 616.827.4652

Please notify us at stocks@acton.org or 616-454-3080 ext. 333 of the amount and type of shares given so that we can appropriately record and acknowledge your donation.